AI-powered KYC

for the UK

Financial services have to comply with KYC requirements overseen by the UK Financial Conduct Authority (FCA). At Onfido we help over 1000 businesses navigate KYC and AML requirements, build best-in-class onboarding experiences, and stop sophisticated fraud — all in one, end-to-end platform.

How can Onfido

help your business?

What are KYC regulations in the UK?

For financial services the UK recognises the Financial Action Task Force (FATF) as the "international standard setter" for AML and KYC requirements. There are various UK laws that govern AML and KYC requirements, primarily:

The Terrorism Act 2000

The Proceeds of Crime Act (POCA) 2002

The Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017 (MLRs 2017)

How can UK businesses verify identity?

The UK Financial Conduct Authority (FCA) is well known for its forward-thinking approach to innovation, with the UK ranking as the second strongest ecosystem in the world according to FATF. It favours a risk-based approach, focussing on outputs rather than prescriptive AML rules stating: “firms must have in place policies and procedures in relation to customer due diligence… but neither the law nor rules prescribe in detail how firms have to do this.”

Similarly the Joint Money Laundering Steering Group (JMLSG) does not prescribe a particular eKYC technology. Instead it sets out the overarching requirement that, “when using an electronic source or digital identity to verify a customer’s identity, firms should ensure that they are able to demonstrate that they have both verified that the customer exists, and satisfied themselves that the individual seeking the business relationship is, in fact, that customer.” How this requirement is satisfied is left to a business' discretion. Many opt for document and biometric journeys, in order to reduce costs, combat fraud, and optimise user experience.

Is Onfido Trust Framework certified?

We enable some of the UK’s leading financial services businesses to automate identity verification at onboarding. We’re certified for both medium confidence profile M1A and high confidence profile H1A under the UK Digital Identity and Attributes Trust Framework — serving use cases for both profiles where digital identity verification is required. This trust framework is part of the UK government’s wider plan to make it easier and more secure for people to prove their identity online. It provides a set of rules for organisations to adhere to in order to provide secure and trustworthy digital identity. The Home Office now recommends companies use identity service providers (IDSPs) that meet the trust framework standards for Right to Work, Right to Rent and Disclosure and Barring Service’s (DBS) screening checks.

Take an interactive tour of the Real Identity Platform

Identity verification solutions for the UK

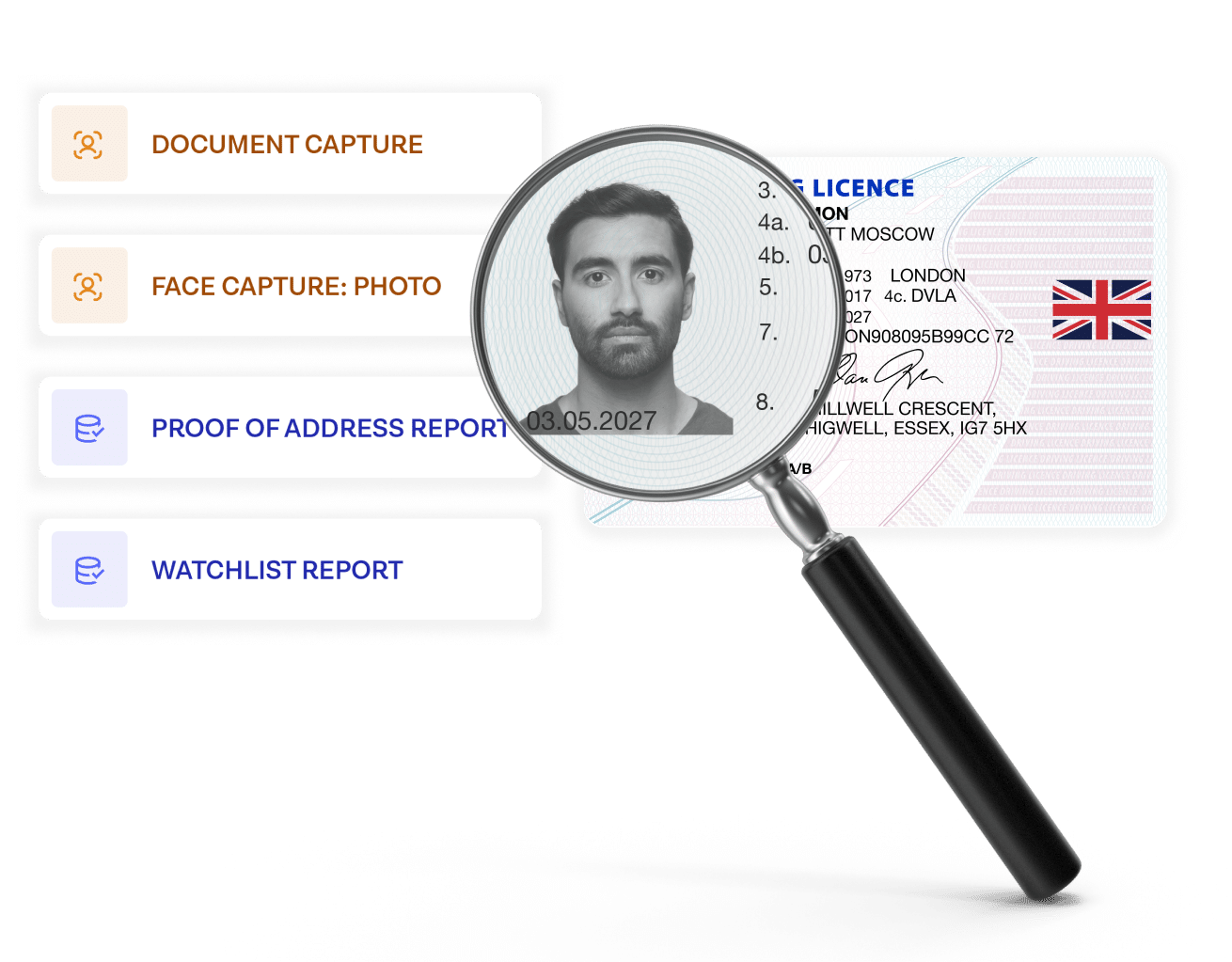

Document and Biometric Verification

Have confidence in your customer’s identity by verifying 2500+ UK and global photo IDs. Powered by Atlas™ AI, our Onfido document verification uses advanced techniques to assess documents for authenticity.

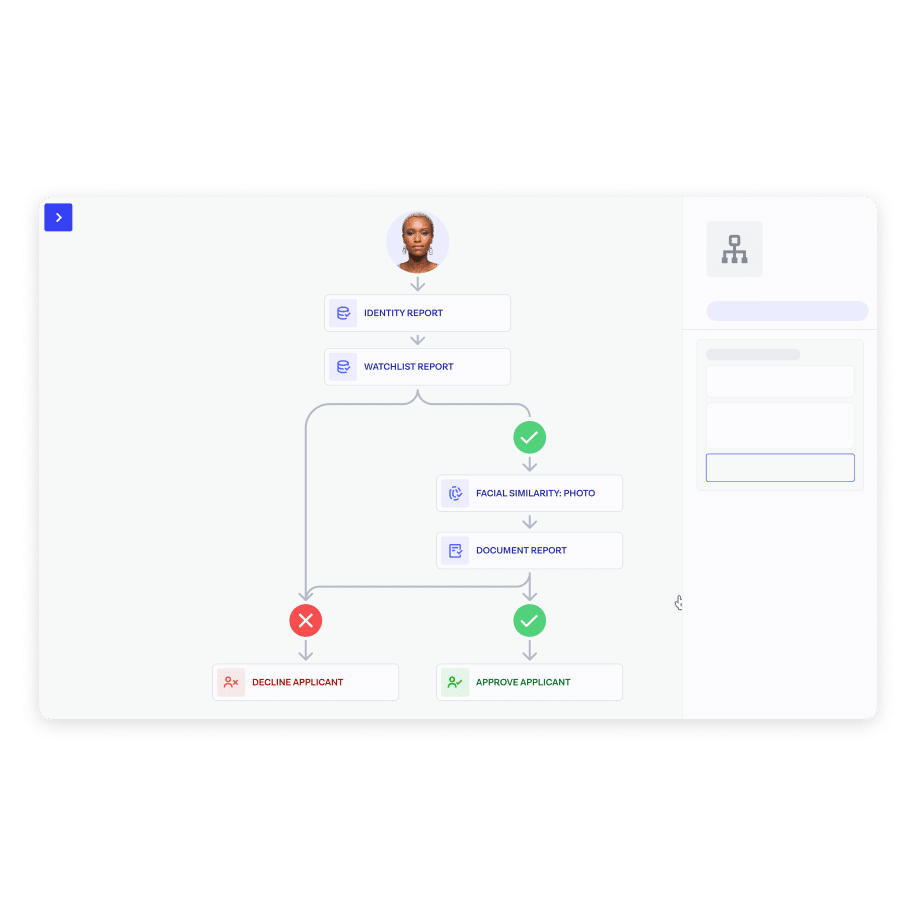

Onfido Studio

Build identity verification workflows according to your needs in our drag-and-drop orchestration tool. Users are automatically routed to the path that makes the most sense for them to maximise conversion and minimise risk.

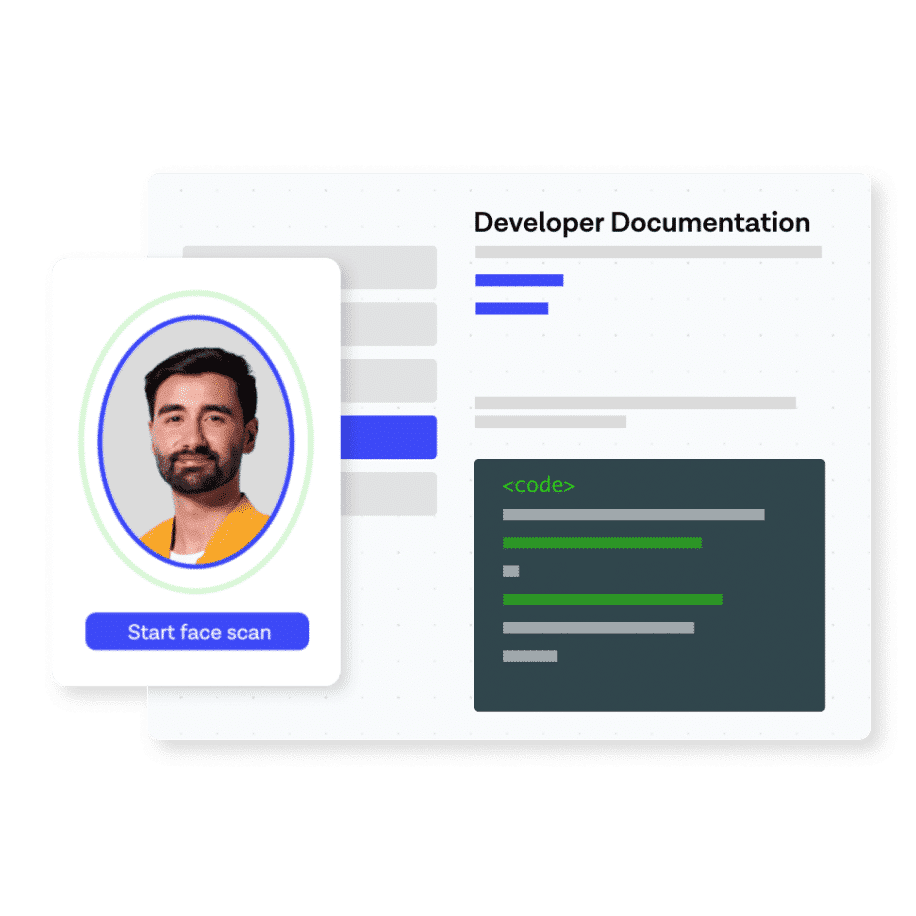

Smart Capture

Make document and biometric capture seamless with our Smart Capture SDKs. They feature glare and blur detection, multi-frame image capture, and WCAG AA accessibility features.

Data Verification

Validate user-submitted data against a range of trusted data sources globally and locally. Choose a range of database verification methods including Identity Record, PEPs and Sanctions Watchlists, and more.

Fraud Detection Signals

Analyse passive fraud signals like phone and device intelligence to catch organised fraud without introducing additional user friction.