to verify new customer identities

from ‘concept’ to ‘market ready’

The partnership

At Onfido, we’re helping businesses transform how they know their customers as they move from face-to-face to digital interactions. This is a mission shared by Vodeno, an Onfido partner. Founded in 2018, their goal is to be the leading digital financial services platform, taking banks from the branch to the cloud with ease.

Onfido and Vodeno teamed up to power Belgian-based challenger Aion Bank’s digital offering. Vodeno provides the full core banking suite for Aion Bank. And Onfido ensures that the Aion Bank team knows the real identities of their customers in the digital world.

The challenge

Aion Bank is building a new way of banking that blends the best of traditional banks with the ease of access of digital challengers. Aion Bank needs its services to be inclusive, safe, and make customers’ lives easier.

As a digital-first bank, Aion Bank must ensure that they’re fulfilling regulatory requirements such as Know Your Customer (KYC). In a traditional branch-based setting, this could be achieved with manual, face-to-face interactions. But they wanted to avoid this for two reasons: industry disruption and customer experience.

For Aion Bank, making the banking experience safe and simpler for customers starts with the push of a button — branch-based interactions simply wouldn’t do. Faced with this, Aion Bank needed a solution that could give them strong confidence in their customers’ identities in a remote setting, without introducing unnecessary friction into the process.

The solution

As Aion Bank’s core banking provider, the Vodeno team set out to find a verification partner that would complement their cloud-based approach. Vodeno wanted a partner that could help them connect the dots of core banking and identity verification.

Vodeno wanted a long-term partner that could help Aion Bank exceed their business objectives in the long term. After assessing criteria from customer feedback, to check turnaround time and uptime, Vodeno chose Onfido as their identity partner.

Tomasz Motyl, Chief Information Officer, Aion Bank

The results

Onfido is helping both partner and client fulfill their business objectives. Vodeno needs a partner they can rely on at scale, and Aion Bank needs to make customer onboarding as seamless as possible to stand out from the competition.

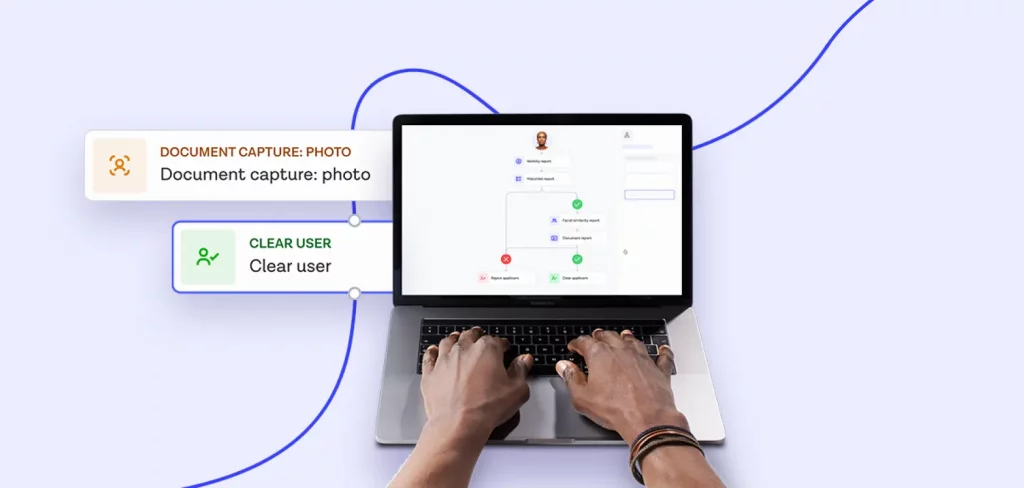

Integrating Onfido into the Vodeno x Aion Bank experience was a breeze. With Onfido’s SDKs for web and mobile, and our comprehensive documentation, Vodeno could seamlessly bake Onfido into Aion Bank’s onboarding process in just 8 weeks.

Onfido’s built-in assisted image capture SDK is helping to guide customers through the identity verification process, too. Customers are verified within 2 minutes on average, and are converting more than alternative methods. With Onfido, Aion Bank is able to approve 7% more customers first time around.

For Vodeno, partnering with Onfido has enabled them to solidify their relationship with Aion Bank. Throughout the partnership, we’ve been on-hand to walk Vodeno through performance and suggestions on a weekly basis, giving Vodeno and Aion Bank a reliable base to build and expand their digital experience.

About Aion Bank

Aion Bank is a subscription-only digital bank with a modern, human touch. They’re on a mission to build the bank of the future, combining the best in digital technology with the breadth of services of a traditional bank.