Document and biometric verification solution from Onfido enables Banca Profilo to verify users securely and quickly for a streamlined customer onboarding experience.

Tinaba, the Italian financial technology (fintech) partner of Banca Profilo, has partnered with Onfido, the global identity verification and authentication company, to automate customer onboarding with AI-powered document and facial biometric technology.

Tinaba is a fintech provider which brings together payments with new digital banking services for consumers, retailers and corporates. As the company onboards new users online, Tinaba with Banca Profilo wanted an identity verification provider to automate the onboarding process, efficiently detecting fraud and streamlining know your customer (KYC) and anti-money laundering (AML) requirements.

Onfido’s award-winning technology helps to simplify the onboarding process, empowering Tinaba with Banca Profilo users to verify their identity securely and quickly within minutes.

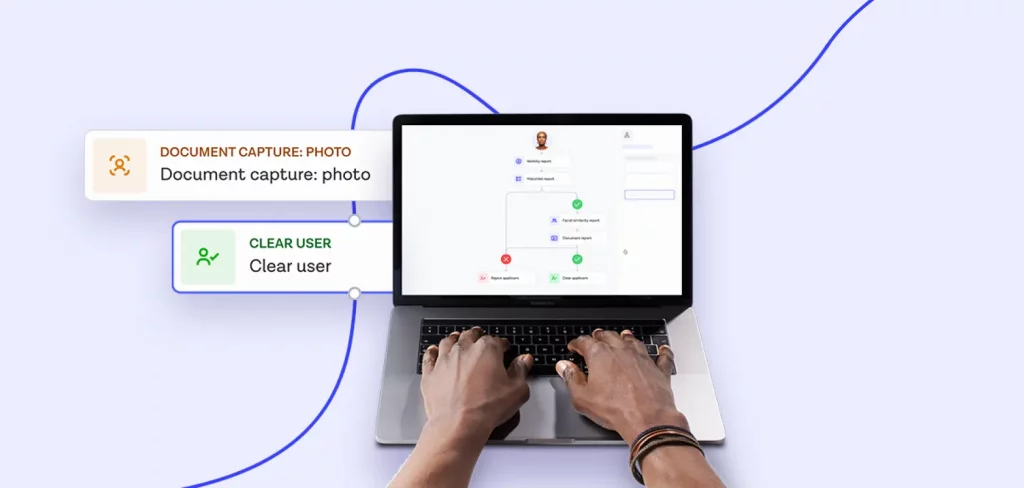

- New users take a photo of their government-issued identity document (ID) and a quick selfie video.

- Onfido first checks that the ID is genuine and not fraudulent.

- Then with biometric recognition technology, Onfido checks that the selfie video is real and live and matches with the ID. This ensures the person presenting the identity is its legitimate owner and is physically present.

- Users are able to start their digital journey anywhere, anytime, through a simple and user-friendly online experience that meets regulatory requirements.

“Tinaba with Banca Profilo’s forward-thinking approach to digital banking puts customer experience, identity fraud prevention and compliance at the forefront,” says Oliver Krebs, SVP EMEA at Onfido. “Onfido’s technology brings trust to digital transactions worldwide and we’re pleased to support Banca Profilo in achieving this digital initiative, realising gains in customer experience, operational efficiency, and risk prevention.”

Read Forrester's Total Economic Impact™ of Onfido to understand how identity verification can deliver benefits across customer acquisition, process automation, fraud detection, and KYC compliance.