Rapid identity verification, using biometric technology, enables a seamless customer journey for users.

Tesco Bank today announces a partnership with Onfido, the global identity verification provider. Onfido provides a secure application process for new Tesco Clubcard Pay+ customers, following the launch of the new product in January.

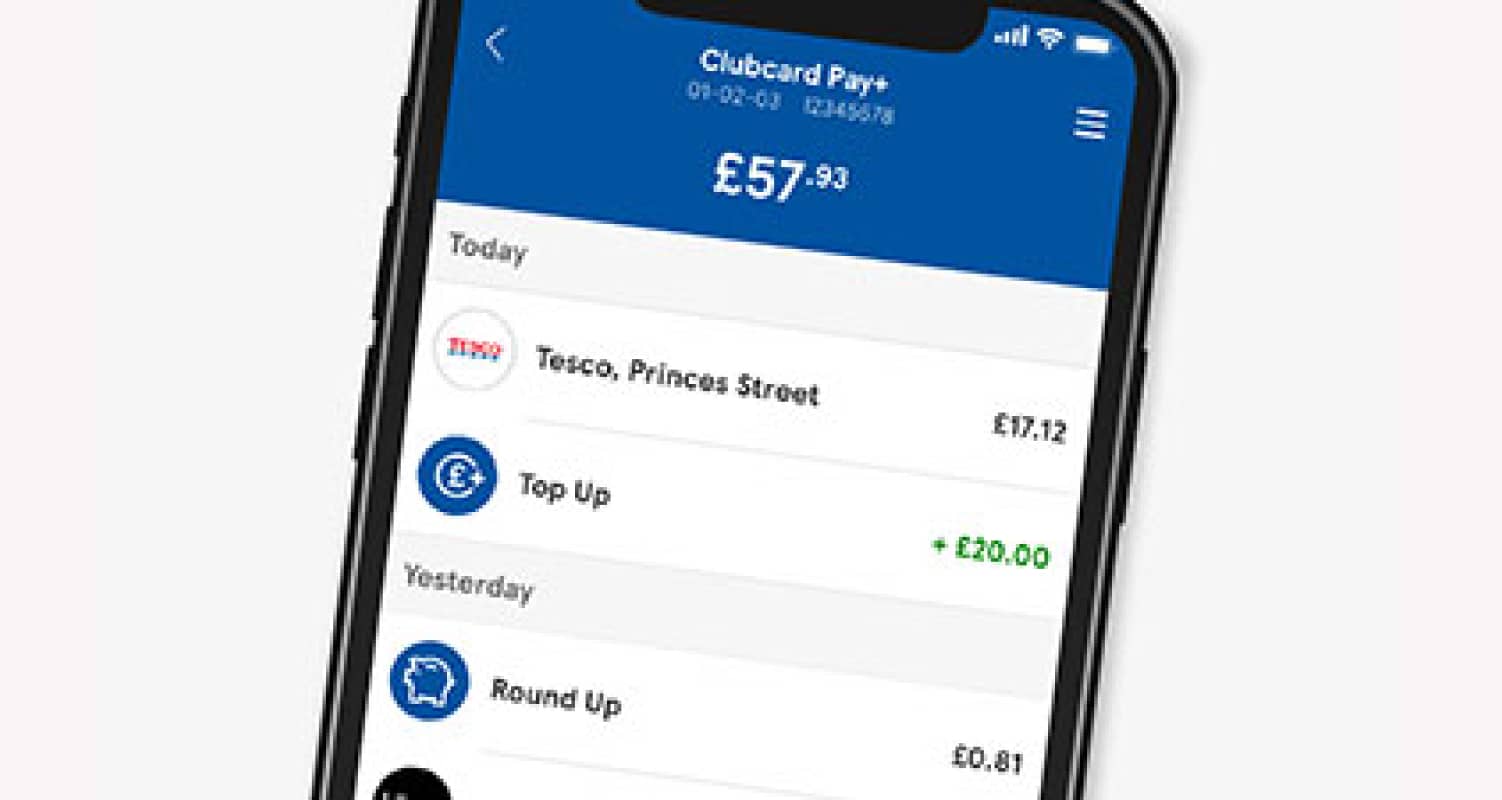

Tesco Clubcard Pay+ is an innovative first for the UK market, allowing Clubcard members to pay with their Clubcard and pick up extra Tesco Clubcard points wherever they shop. Shoppers can add money and ringfence their grocery spend from any UK bank account into their Tesco Clubcard Pay+ account, using the free Tesco Bank mobile banking app. Clubcard Pay+ also gives shoppers the power to save while they shop by rounding up their purchases to the nearest pound, saving the difference into a Round Up account. Tesco Bank also plans to introduce additional features to Clubcard Pay+ which will further help families to budget and save whilst being rewarded for their spending.

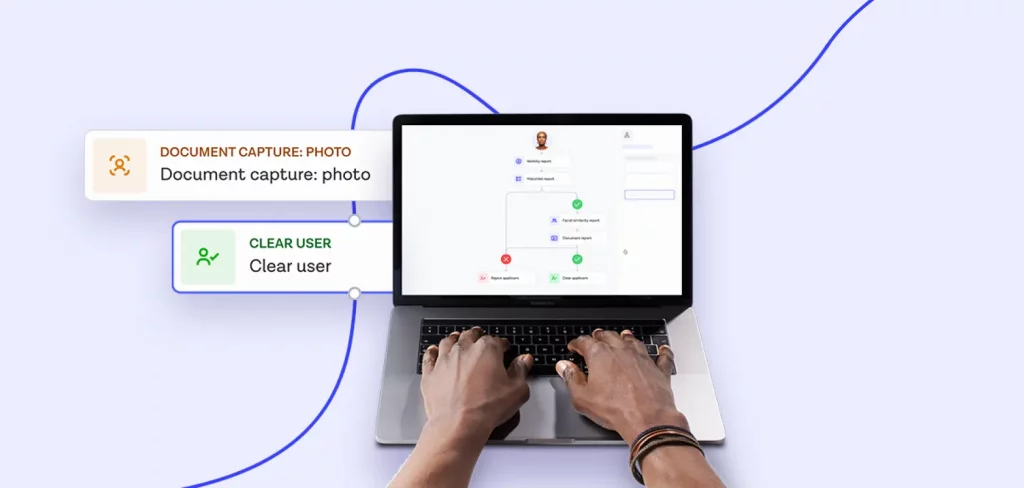

Tesco Bank’s partnership with Onfido enables a smooth and fast online user journey for customer applications by using digital identity verification to streamline the process. Rather than filling out postal applications, customers can apply directly through the Tesco Bank mobile banking app. Users simply take a photo of their government-issued identity document (ID) and a selfie. Onfido first checks that the ID is genuine and then matches it with the user’s face. This ensures that the person presenting the identity is the rightful owner of the ID and is physically present. This will allow customers to prove their identity anywhere and anytime with a quick and user-friendly process to open an account.

Sigga Sigurdardottir, Chief Customer Officer at Tesco Bank

Onfido’s advanced identity verification prioritises security, preventing fraudulent application attempts while meeting all industry regulations designed to keep users and businesses safe.

Onfido’s unique SDKs, now integrated within the user-centric design of the Tesco Bank mobile banking app, includes glare and blur detection, which provides real-time feedback to help users submit high-quality pictures for document verification. Additional features, such as Optical Character Recognition (OCR) Autofill, extracts data from the ID to prefill the application form to streamline the account opening process further. Clubcard Pay+ customers can benefit from this improved experience using a desktop computer, laptop, tablet or smartphone.

Mike Tuchen, Chief Executive Officer at Onfido

Watch the webinar with experts from Tesco Bank, HSBC, 11:FS and Onfido to hear about the evolution of onboarding and how customer demand is changing.